Who needs a Personal Financial Statement (PFS)?

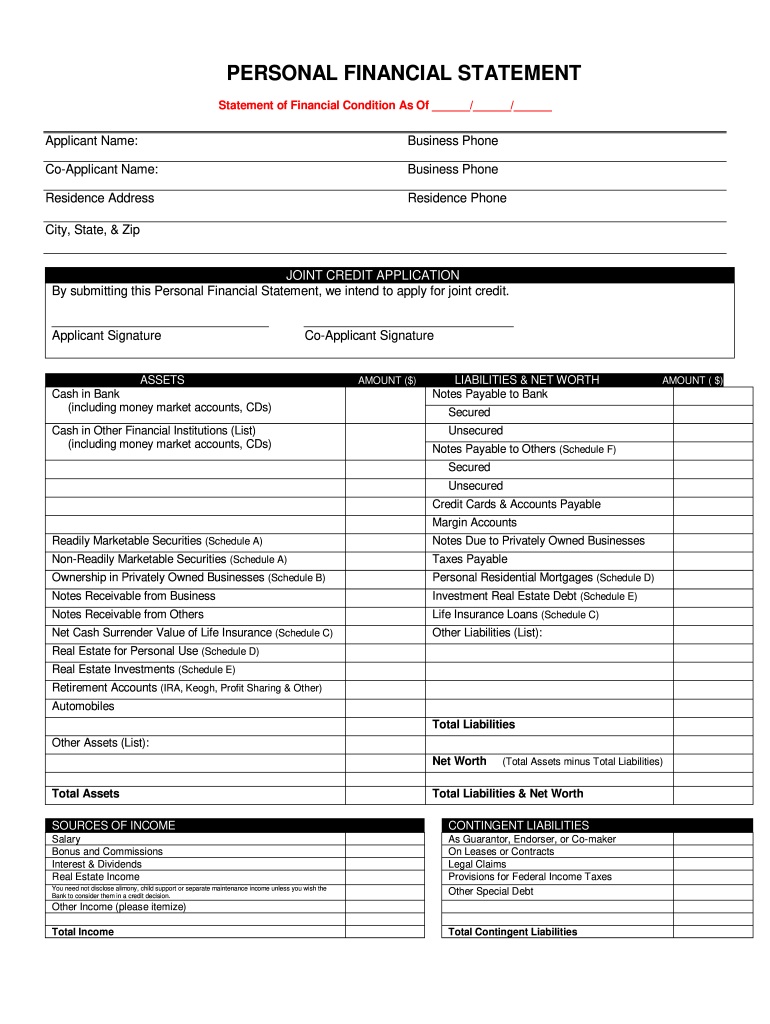

Any individual applying for a bank loan needs to provide his/her personal financial statement to the bank. An applicant may apply for an extension of credit individually or jointly with another applicant.

What is the PFS for?

Before extending a loan to an applicant, the bank has to evaluate the financial condition of the potential borrower. The applicant’s financial statement provides the bank with the information it needs to make the evaluation.

Is the PFS accompanied by other forms?

You do not have to file any other form but this one.

When is PFS due?

You and your bank agree upon the date of filing.

How do I fill out PFS?

The Form contains some instructions on how to fill it; please read the instructions carefully before you start filling the form.

You should provide the following information:

(1) Personal information including name, address, social security number, information about you current and previous employment, dependents, marital status;

(2) Assets including cash; securities; life insurance cash value; mortgages and contracts held by you; homestead; other real estate; profit sharing & pension; retirement accounts, including IRA accounts; automobile; personal property; and other assets.

(3) Liabilities: short terms notes due to financial institutions; short term notes due to others; credit accounts and bills due; insurance loans; installment loans and contracts; mortgages on home; mortgages on other real estate; taxes; and other liabilities.

You will have to give detailed information concerning most of the items above, completing respective schedules.

You should also provide information about your annual income including salary, bonuses, commissions, dividends, interest, net real estate income.

The form requires you to answer the following questions:

-

Are you a co-maker, endorser or guarantor of any other person’s debt?

-

Are you a defendant in any suit or legal action?

-

Have you ever gone through bankruptcy or had a judgment against you?

-

Have you made a will?

Finally, you should sign and date the Form.

Where do I send PFS?

You should send your Personal Financial Statement to your bank.